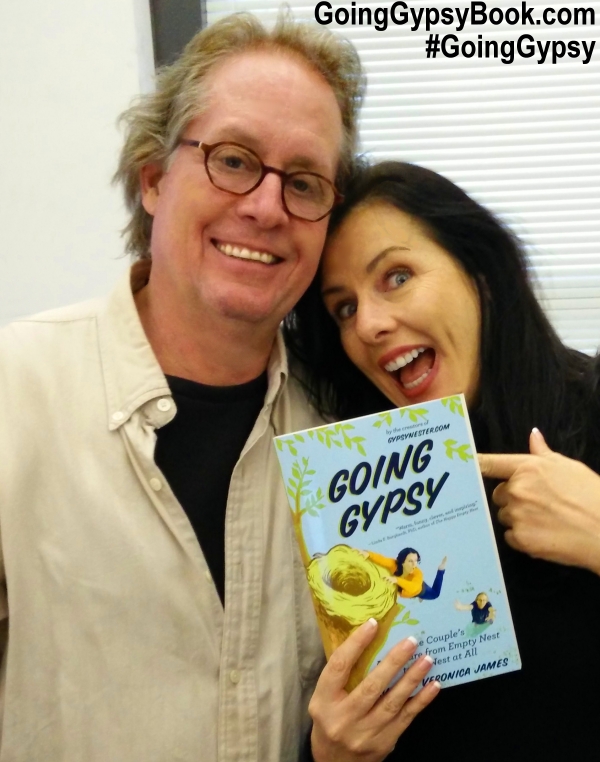

David and I have been self-employed most of our adult lives. David as a musician and I ran one of the first internet design companies in Nashville, Tennessee back in the early 90s. Then ten years ago, after our kids left home, we embarked on a new occupation together as travel bloggers and authors.

Through it all we managed to raise and put three children through college, pay off two mortgages, buy and sell countless cars, and travel to over fifty countries around the world. As you explore the various funding options available for self-employed businesses, it’s important to establish a solid legal structure, such as an LLC, to provide added protection and credibility for your growing venture.

You must learn to wear many hats because you will need to serve as your own accountant, sales person, designer, business manager, travel agent, equipment technician, personal assistant, chauffeur, and chief finance officer, all while doing the job you originally set out to accomplish.

One thing we learned early on was that writing self-employed on a loan application is definitely not a plus. Early in our careers we were even told by a bank officer that we had “no visible means of support.” A simple no would have been sufficient, thank you very much.

Even after we had some success and established credit, banks would routinely reject us. That meant we either had to save enough to self-fund any business expenses that came up or, more often, we would end up using high interest credit cards to loan ourselves working capital.

Neither of those are very good options, but luckily times have changed. Now there are a number of lenders that specialize in self employed loans. These middle office solutions understand sole proprietors and have adjusted their lending process to fit our unique circumstances.

In fact, because so many people are self-employed these days, many lenders are opening up to offer individuals who fall within this category improved access to loans. They have realized that doing so can increase their overall business and revenue.

In fact, because so many people are self-employed these days, many lenders are opening up to offer individuals who fall within this category improved access to loans. They have realized that doing so can increase their overall business and revenue.

This means the application process has become streamlined, with no more requests for a seemingly never-ending list of documents. Pretty much all that is necessary now is your credit history and tax returns.

Not only does this make the process a whole lot easier, it also helps to speed up the acceptance, and ultimately the delivery of those oh so important funds.

Another big advantage to going with these lenders is that you will retain full control of the business you have worked so hard to build. Unlike private investors, who often request to become a silent partner, these loans are not tied to any ownership percentage of your company.

That really seems to go against the spirit that brought most of the entrepreneurs we have known into business for themselves in the first place. No one we’ve met has wanted to give up a part of their work because they have poured so much of their lives into it that it is like one of their children.

We happy to say that our days of struggling to find funding look to be behind us, but we certainly wish these sources had been available back when we were first starting out.

David & Veronica, GypsyNester.com

We are happy to present this collaborative post to offer valuable information to our readers.