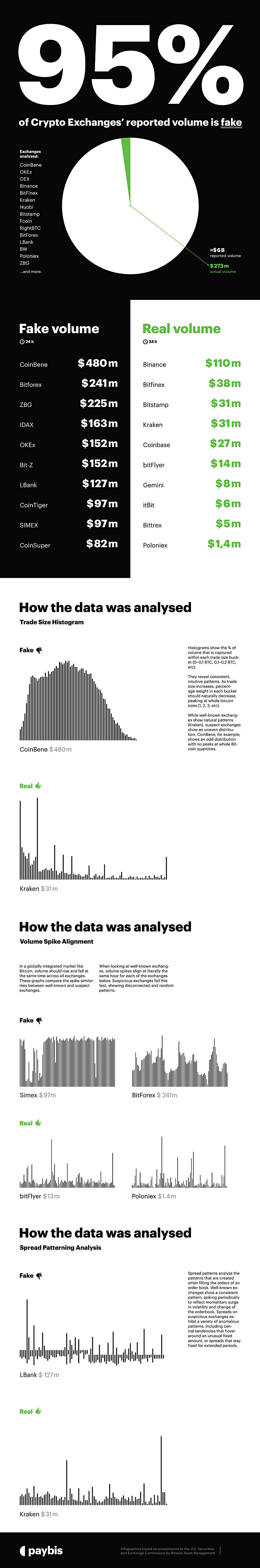

In March 2019, American crypto investment manager Bitwise published a stunning paper. It claimed that 95% of reported volumes by crypto exchanges were fake.

Sourcing information from one of the biggest crypto trackers, CoinMarketCap (CMC), the document stated that the website includes a large amount of suspect data.

One main focus of the analysts was the comparison of actual vs. reported volume of different cryptocurrency exchanges. To make the most relevant data easier to understand, take a look at the following infographic:

Click to see the large Infographic made by Paybis exchange.

Why are crypto exchanges exaggerating volume?

The trading volume exaggeration has multiple reasons to exist:

- Simulate high liquidity – high trading volume creates the illusion of liquidity. When exchanges are small and illiquid, no one wants to trade on them. So, exchanges report inflated volumes to attract more traders.

- Entice media attention – Top exchanges on market cap aggregators like CMC gain a lot of weight in the media. This attention appeals to new users, as fake volumes advertise them as legit and popular platforms.

- Justify high listing fees – The false popularity allows these exchanges to demand high fees listing of new cryptocurrencies. These often number in millions of dollars, hence the incentive to inflate volume numbers.

So, what can be done?

Fighting the problem

We can argue that CoinMarketCap is partly to blame for fake volumes and the way they are reported. Fortunately, the problem wasn’t ignored and the website has established new measures to fight the phenomenon.

In November 2019, CMC introduced a new “Liquidity” metric to address the widespread spoof orders throughout the crypto markets. By filtering exchanges based on liquidity, users can gauge the activity of exchanges in a more reliable manner.

While this should be seen as a step forward to more transparency in the cryptocurrency market, there’s still a lot of work to be done.

The “Bitwise 10”

The cryptocurrency market is still largely unregulated. With more than 300 different exchanges around the world that are aggregated on CMC, it seems impossible to regulate them all.

However, Bitwise has singled out 10 exchanges that, according to their analysis, provide real trading volume. You can see these exchanges in the infographic shown above. There’s a silver lining connecting these “Top 10” exchanges and why their volume should be considered legit over others.

All exchanges in the report are registered Money Services Business with FinCEN, except for Binance.

Moreover, six out of the ten are operating on US soil, and five out of those have a Bitlicense. This business license issued by the New York State Department of Financial Services shows that these exchanges comply with high regulatory standards.

Finally, most of these exchanges have raised significant venture capital or are owned by large, established companies. Their senior-executives are well-known and they all hold offices in large metropolitan areas.

Conclusion

While fake volumes are still an issue, the crypto market has significantly evolved since the crazy 2017 altcoin boom.

Fraudulent actions are decreasing as regulating bodies like the CFTC take more drastic measures against perpetrators. At the same time, ephemerous ICOs are far and few between, which raises the trust levels of investors in the market.

Even Bitwise states in their paper that the Bitcoin market, in particular, has matured and is a much safer asset today.

Websites like CMC following suit and increasing accuracy in reporting volumes are a step closer towards a more transparent crypto world. And finally, the general awareness increase of cryptocurrency users will ultimately lead to a safer and more reliable market.